The Most Fascinating Financial Experiment of Our Time

MicroStrategy and the mechanics of a Bitcoin Treasury.

I first wrote about MicroStrategy when it entered the NASDAQ 100. Since then, it has grown into a financial juggernaut. So when I came across yesterday’s FT piece on Eric and Don Trump Jr. trying to seed Bitcoin treasury listings (MicroStrategy equivalents) in Asia, I decided to dive deeper into MicroStrategy. What follows is a long, slightly technical rabbit hole.

Background: What is MicroStrategy?

In 2020, Michael Saylor turned MicroStrategy (MSTR) from a sleepy software company into the world’s first publicly traded Bitcoin treasury vehicle. By raising billions through debt and equity, then converting that capital into Bitcoin, MicroStrategy pioneered a corporate structure that gave investors a stock-market proxy for the world’s most volatile asset.

This strategy has inspired both admiration and criticism. While admirers call it visionary financial engineering, skeptics call it a Ponzi in disguise. The truth, with like most things, lies somewhere in between. Understanding it requires breaking down how it raises capital, how leverage works, what mNAV means, and why tax treatment makes MSTR especially compelling for international investors.

1. The Mechanics: How It Works

Capital Raising: MicroStrategy issues convertible notes, preferred stock, or new equity.

Treasury Allocation: Proceeds are used to buy Bitcoin, now the dominant asset on its balance sheet.

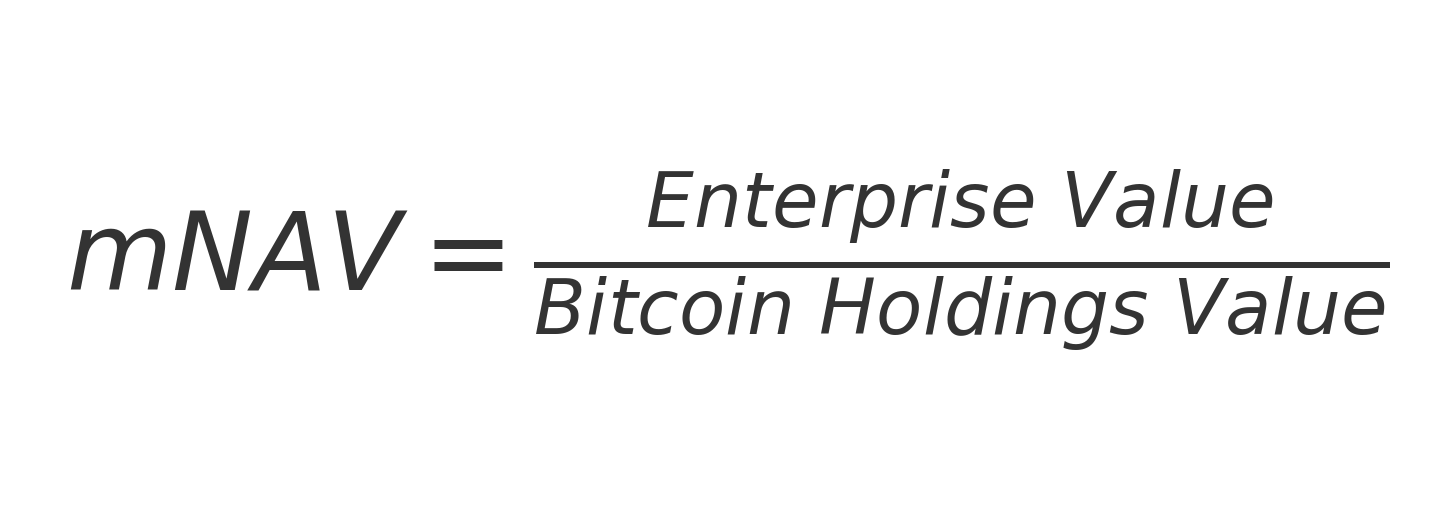

mNAV (Market Net Asset Value): Investors track how much Bitcoin sits behind each share, net of debt.

Premiums and Discounts: MSTR often trades above its mNAV, reflecting liquidity, accessibility, and the “Saylor premium.”

In essence, MicroStrategy functions like a leveraged Bitcoin ETF - without the ETF wrapper.

2. Leverage: The Turbocharger

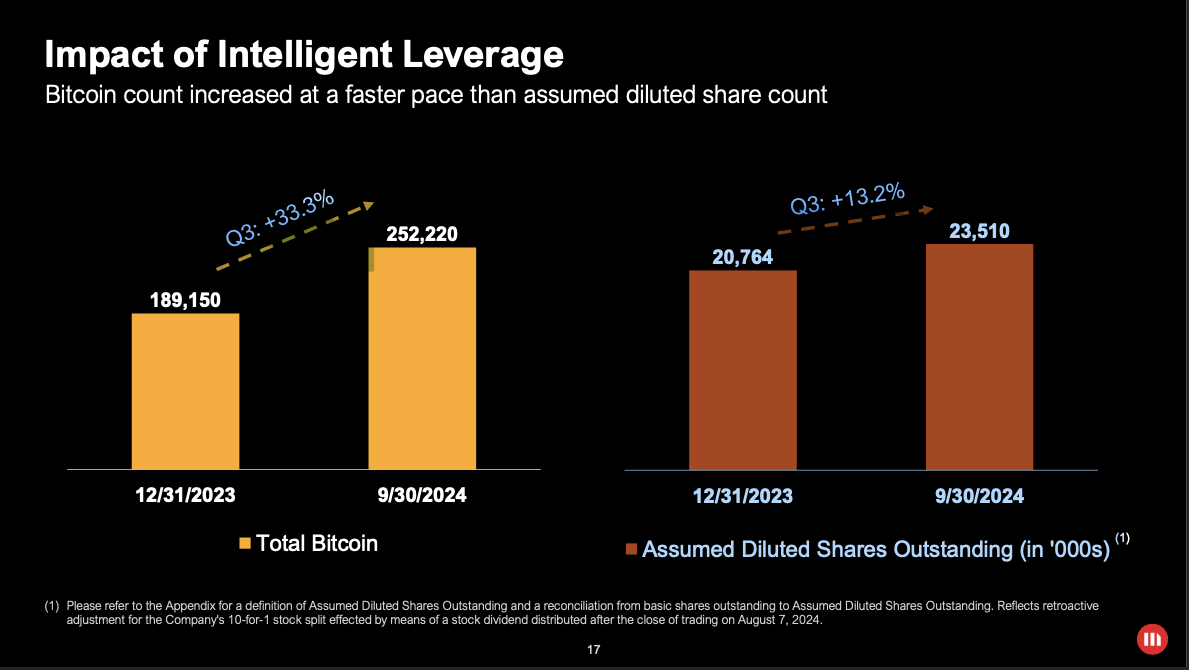

Why They Call It “Intelligent Leverage”:

MicroStrategy uses a mix of debt + equity issuance to buy Bitcoin.

By selling shares of its Class A common stock, the company capitalizes on its market valuation, particularly during periods of high public interest in Bitcoin

But the rate of Bitcoin accumulation outpaced dilution, so each share now represents more Bitcoin than before. The slide is management’s way of saying: “Yes, we dilute shares, but we’re adding Bitcoin at a much faster pace - so shareholders are net winners.”

How do they do this? Leverage.

Leverage is what makes MSTR different from just holding Bitcoin. So far, until in August 2025:

Debt Raised: ~$7.2B in low coupon, long maturity convertible notes over the past five years.

Total Debt + Preferred (2025): ~$11.6B.

Bitcoin Holdings:

592,100 BTC ($63B).Net Bitcoin Exposure: ~$51.4B after subtracting liabilities.

That’s a leverage ratio of ~1.2×. Meaning, theoretically:

If Bitcoin rises 10%, MSTR equity rises ~12-13%.

If Bitcoin falls 10%, MSTR falls ~12-13%.

In practice, premiums expand in bull markets and collapse in bear markets -making MSTR’s swing closer to 1.2-1.5× Bitcoin’s move.

Leverage amplifies outcomes for investors. It’s what makes MSTR beloved in bull markets and brutal in bear ones.

3. mNAV: Measuring the Premium

mNAV is the core valuation yardstick for Bitcoin treasuries. Simply, mNAV if a Bitcoin treasury stock is trading above or below the value of the Bitcoin it holds.

MSTR mNAV urrent Levels (Aug 2025):

Self-reported mNAV: ~1.61

Diluted share mNAV: ~1.57

External estimate: ~1.4

That means MSTR trades at a 40-60% premium to the Bitcoin on its balance sheet. Investors are paying extra for:

Simplicity (stock vs crypto wallet).

Accessibility (fits into brokerages, retirement accounts, funds).

Tax efficiency (lower LTCG of 12.5% vs direct Bitcoin tax of 30% in India).

Saylor’s conviction and relentless accumulation strategy.

But premiums cut both ways. If sentiment turns, they can collapse - dragging MSTR down harder than Bitcoin itself.

4. The Ponzi Debate

Why Critics Call It a Ponzi

Reflexive Issuance Cycle: Stock rises → new equity issuance → buy more Bitcoin → stock rises again. This loop depends on continuous new buyers.

Dependence on Confidence: If the market refuses to buy new stock or bonds, the flywheel stalls.

Detachment from Operations: Core revenues are irrelevant - the business model is financial engineering.

Why It’s Not a Ponzi

Transparency: SEC filings disclose every Bitcoin purchase, debt issuance, and share count.

Real Assets: Bitcoin is liquid and verifiable, unlike fictitious assets in real Ponzi schemes.

No False Promises: MSTR doesn’t guarantee returns - risk and volatility are front and center.

Market Choice: Paying a premium above mNAV is voluntary, not fraudulent.

Verdict: Legally speaking, it’s not a Ponzi - but it is reflexive, reliant on market enthusiasm, and vulnerable if capital inflows dry up.

5. Got it, not a Ponzi. So then is it a bubble?

Funnily, MSTR actually trades like a bubble on top of a bubble:

If Bitcoin itself is in a bubble, MSTR inherits that froth.

Add leverage and premiums, and MSTR becomes a high-beta Bitcoin bet.

That doesn’t make it fraudulent - just very speculative.

6. Why Indian Investors Choose One Over the Other?

Reasons to Buy MSTR

Easy access through international brokerage accounts.

Embedded leverage for higher upside.

Stock-market liquidity, options, and institutional eligibility.

Crypto ETFs fall in a regulatory gray area.

For Indian investors, the tax code also flips the equation:

This alone makes MSTR structurally more attractive for long-term investors in India. A 100% Bitcoin rally could translate into a post-tax return nearly double via MSTR versus direct BTC.

Reasons to Buy Bitcoin

Pure exposure, no corporate risk.

24/7 liquidity.

No premium - you get Bitcoin at spot.

No dilution or dependence on Michael Saylor’s strategy.

Now if Bitcoin itself becomes just as accessible - say, through spot ETFs globally, simpler custody in traditional brokerages, or tax treatment that equalizes it with equities - then much of this premium (wrapper value) disappears.

Implication: The premium could shrink or even vanish, bringing mNAV closer to 1. In that world, treasury listings behave more like leveraged Bitcoin trackers than unique vehicles with embedded advantages.

Final Take

MicroStrategy is not a Ponzi scheme - but it is a leveraged, reflexive Bitcoin proxy that trades at a premium. For some, that premium is worth it: lower taxes, easier access, and turbocharged upside. For others, the purity of Bitcoin itself is preferable.

The reality is that MSTR is a Bitcoin Bubble. What you’re buying is not Bitcoin, but the mechanics of leverage, premiums, corporate governance, and tax arbitrage.

And that makes it one of the most fascinating financial experiments of our time.