Chip wars, Nvidia earnings, and China

Exploring the evolving Nvidia-China Relationship and the future of compute.

Three days ago, Nvidia reported $44.1 billion in revenue for Q1 FY2026 (February 2025 to April 2025), up 69% year-over-year, with $4.5 billion in profit. Despite mounting US-China tensions and export bans, Nvidia’s earnings indicate that global AI demand is surging. However, the balance of power in the chip industry is slightly shifting.

To understand why Nvidia’s earnings held strong, we need to step back and examine its evolving relationship with China - and how US policy has shaped the battleground.

Nvidia and China: A critical relationship (Pre-2022)

Before US limited chip exports to China, China accounted for ~20% of Nvidia’s data center revenue. Chinese tech giants - Baidu, Tencent, Alibaba, ByteDance - depended on Nvidia’s A100 and H100 GPUs to train AI models across language, vision, and video tasks. In fact, even DeepSeek was trained using Nvidia’s A100s.

“By 2021, Liang [founder of DeepSeek] had started buying large quantities of Nvidia GPUs for an AI project, reportedly obtaining 10,000 Nvidia A100 GPUs before the United States restricted chip sales to China.”

It’s clear that Nvidia’s hardware laid the foundation for China’s AI development.

Biden’s export controls (2022–2023): The first blow

In October 2022, the Biden administration introduced strict export controls. Any AI chip capable of enabling a supercomputer with over 100 petaflops FP64 or 200 petaflops FP32 in a 41,600 ft³ system was now restricted.

As a result, the A100 and H100 were suddenly off-limits for China.

To maintain sales, Nvidia engineered a workaround: the H20 - a downgraded version of the H100. The H20 was a compromise: not as powerful as the H100, but within legal limits.

This was still lucrative for Nvidia, but the policy was signal for China to start urgently developing in-house alternatives.

China’s response (2024-2025): The chip push

China has poured $27.5 billion into semiconductor R&D, AI chip design, and data centers. Huawei’s Ascend 910B was developed as a result of this, which now serves as the current flagship chip, deployed in over 9,000 servers at China Mobile.

Trump’s H20 Ban (2025): The second blow

In April 2025, the Trump administration raised the bar further.

The new thresholds banned any AI chip with >70 TFLOPS FP32, or >600 GB/s interconnect bandwidth.

The H20, Nvidia’s carefully designed compromise, was also now illegal to sell to China.

The financial impact to Nvidia was immediate. Nvidia took:

a $4.5 billion write-down on unsold H20 inventory

missed $2.5 billion in sales

projected an $8 billion hit for the following quarter

The silver lining: Global demand outpaces the China loss

In the AI race, hyperscalers - Microsoft, Google, Meta, Amazon - are absorbing every GPU Nvidia can ship. The AI buildout in the U.S., Europe, and the Middle East has more than offset the loss of the Chinese market.

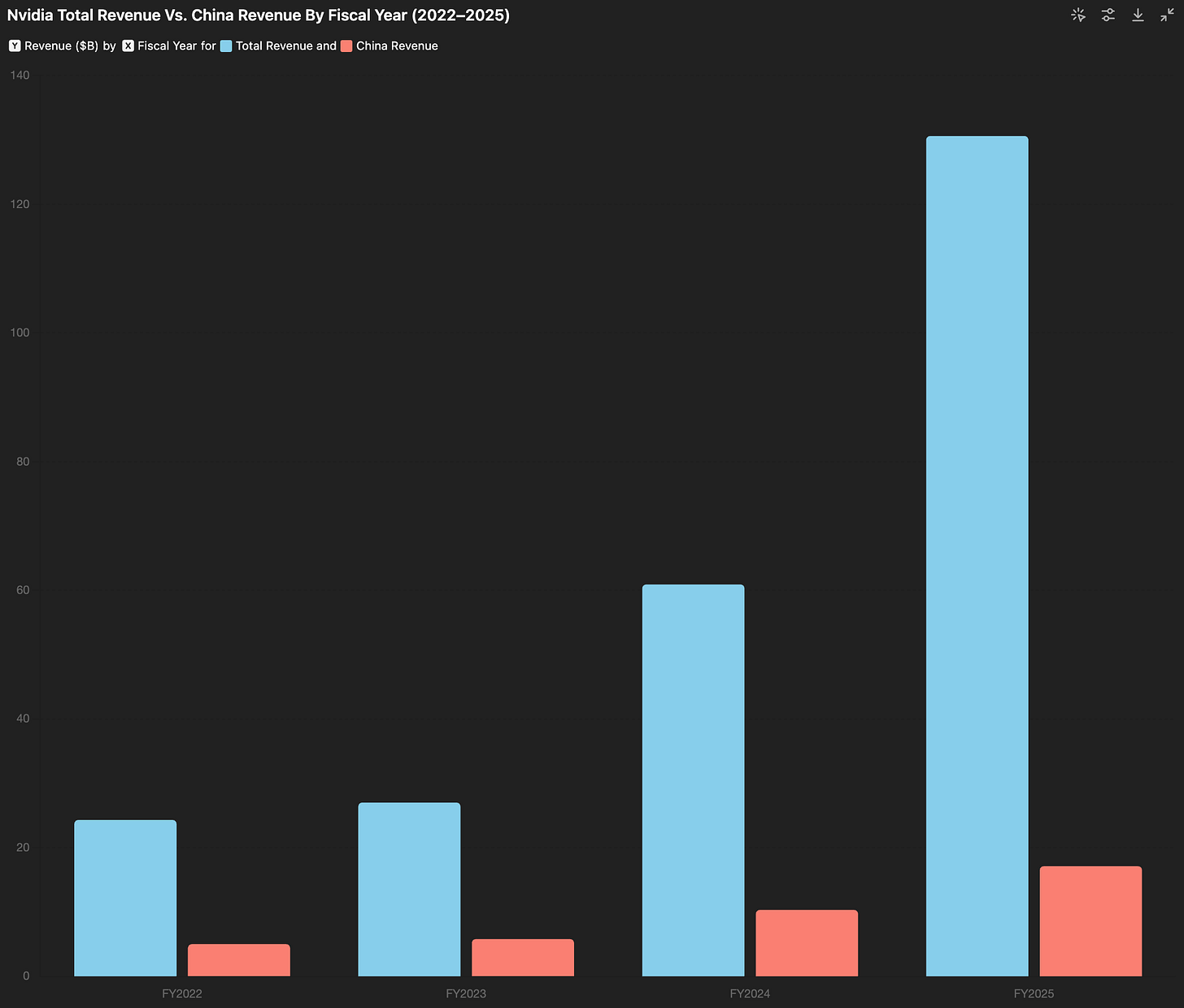

We observe the trend in Nvidia’s China revenue in subsequent years:

FY 2023: ~$5.79 billion, accounting for 21.45% of total revenue.

FY 2024: ~$10.31 billion, representing 16.92% of total revenue.

FY 2025: ~$17.11 billion, making up 13.11% of total revenue.

While Nvidia’s revenue from China has grown in absolute terms, its share of total revenue has declined. Hence as Nvidia diversifies its chip demand, the impact of aggressive anti-China policy on its revenue is reducing - at least in percentage terms.

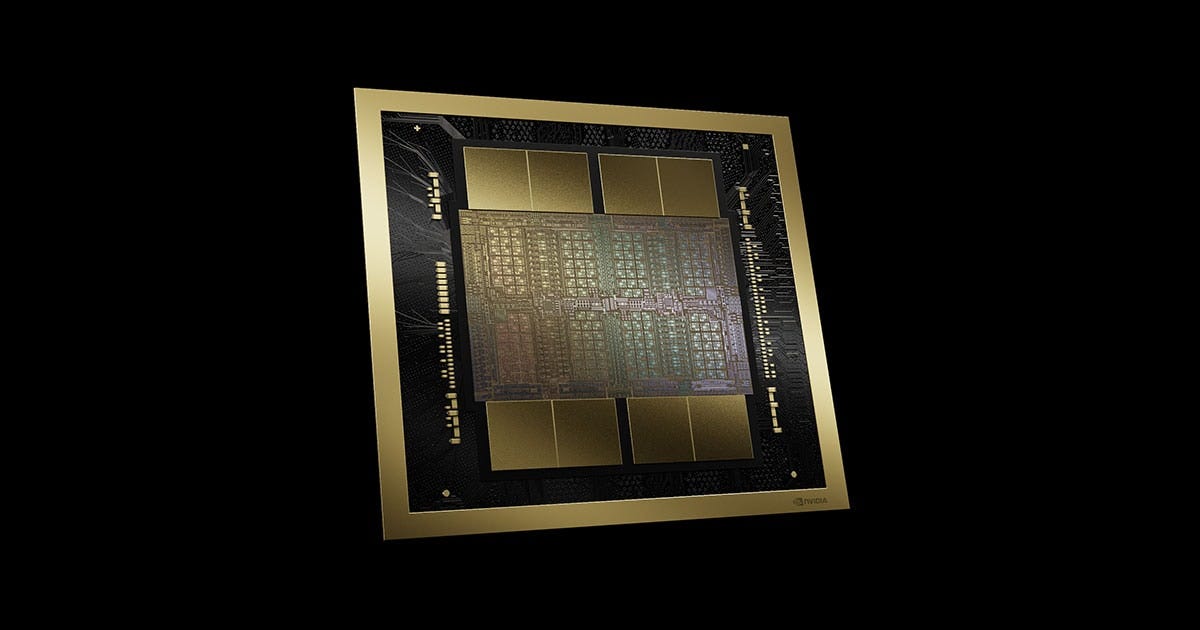

Blackwell: Nvidia’s Next Generation (2025+)

Nvidia’s future rests on Blackwell: a next-generation architecture designed for the GPT-5 era. The B100 and B200 chips will power the next wave of AI workloads: large language models, robotics, video AI, and multi-modal systems.

Once again, restricted versions are being prepared for China - B40 and RTX Pro 6000D - crippled enough to stay under export thresholds.

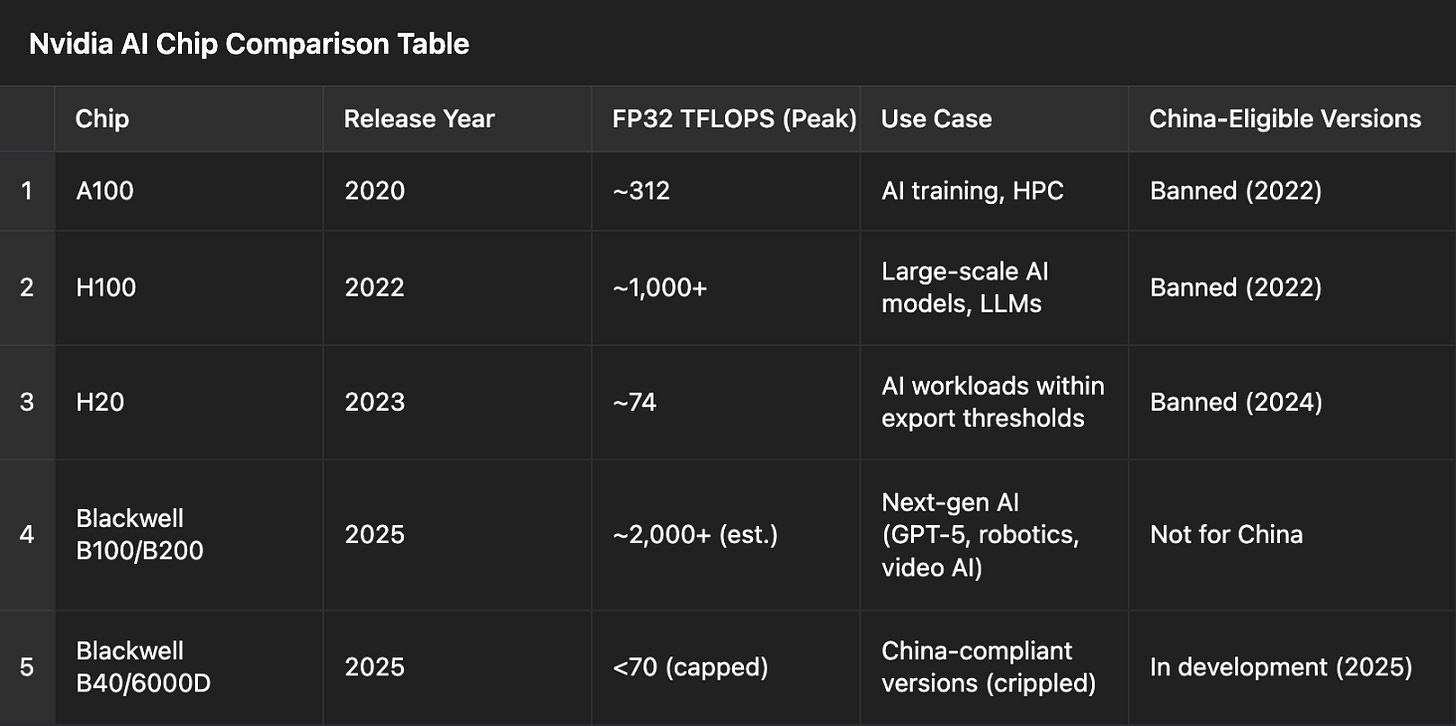

Here’s how Nvidia’s chips compare:

The Takeaway

Congratulations to Nvidia on their Q1 earnings! It showed the continued strength of global AI demand, but also reminded us of the fragility of the AI supply chain in a geopolitically divided world.

While Huawei’s chips lag behind in efficiency, lack the CUDA ecosystem, and depend on SK Hynix (a Korean company), China’s resolve is strong. The lead Nvidia holds is not guaranteed forever.

Amid this as consumers, we are fortunate to live in a time where AI can summarize medical scans, generate personalized financial advice, and run smarter home assistants that understand your daily routines. And as investors, we must decide how to allocate funds across geographies with clarity as the landscape evolves.

Thanks for reading the Paasa blog! If this gave you a fresh perspective on the chip wars, share it with someone who’s watching the AI race unfold.

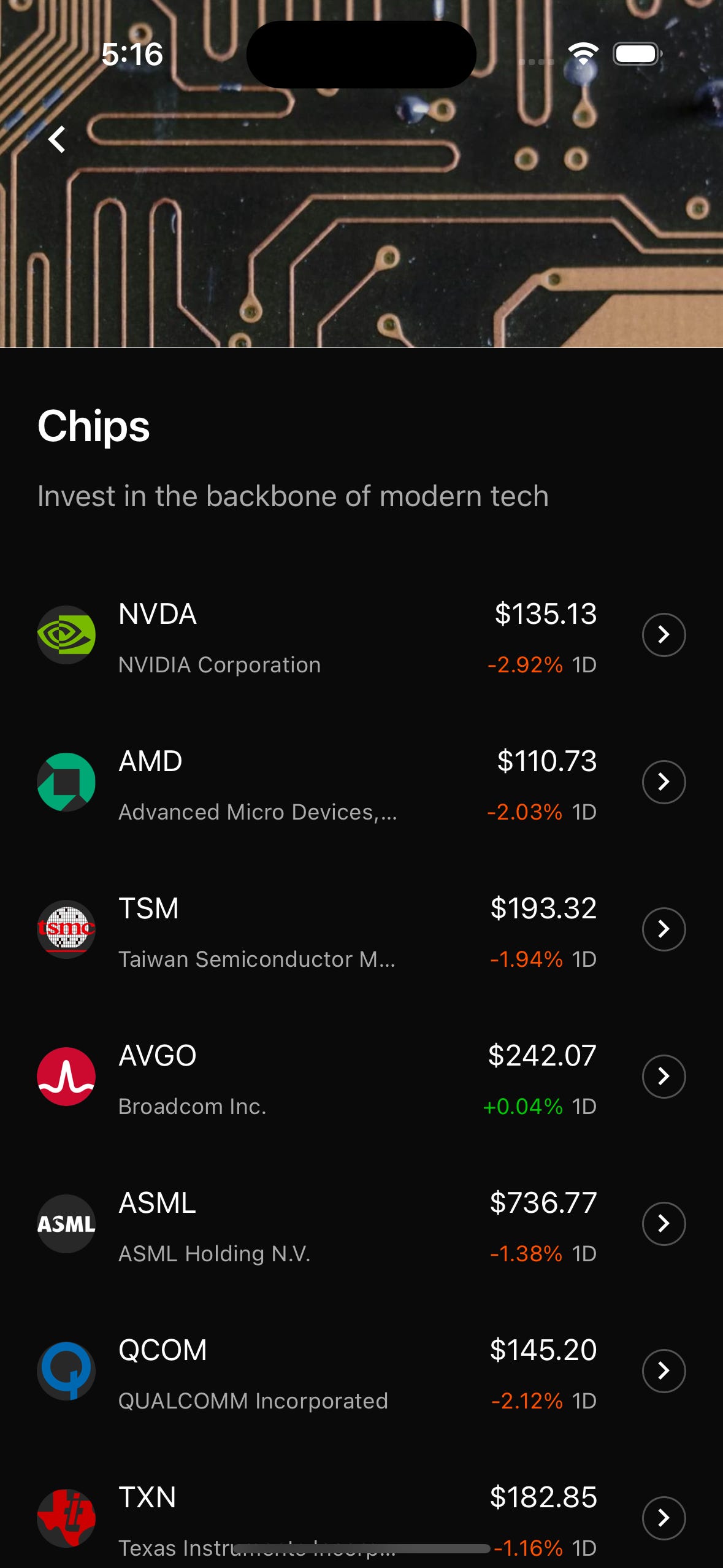

If you want to be part of the AI race, buy stocks from our ‘Chips’ playlist - 10 companies that are shaping the global silicon economy.